Are you losing customers faster than you’re gaining them? Customer churn is one of the most pressing issues for businesses, especially those relying on recurring revenue. Ignoring churn is like pouring water into a leaky bucket—no matter how much effort you put in, your business won’t grow unless you fix the holes.

But reducing churn isn’t just about plugging leaks; it’s about understanding the root causes and implementing strategies that not only retain customers but also enhance their lifetime value. In this guide, we’ll explore proven methods to identify the early signs of churn, leverage predictive analytics to stay ahead of the curve, and implement targeted strategies that have already helped companies.

- Differentiate Between Voluntary and Involuntary Churn: Understanding the distinction is crucial for applying the right strategies—voluntary churn requires engagement tactics, while involuntary churn might be mitigated through technical fixes like payment retry logic.

- Monitor Churn Indicators Proactively: Track engagement metrics, customer complaints, and service usage regularly to identify at-risk customers before they decide to leave.

- Utilise Predictive Analytics: Leverage historical data and predictive models to forecast potential churn and prioritise retention efforts on the most at-risk customers.

- Enhance Onboarding Processes: A smooth onboarding process can set the tone for a long-term relationship, reducing early-stage churn significantly.

- Implement Customer Feedback Loops: Regularly collect and act on customer feedback to address issues proactively and increase customer satisfaction.

- Focus on Long-Term Relationship Building: Strategies like personalised communication and community-building can foster loyalty and reduce the likelihood of churn over time.

- Invest in the Right Technological Tools: Choose CRM and customer engagement platforms that provide advanced analytics and automation capabilities to support your churn reduction efforts.

- Continuous Monitoring and Strategy Adjustment: Regularly review and adapt your churn management strategies to respond to evolving customer needs and market conditions.

What are Customer Churn Rates?

Customer churn, or customer attrition, refers to the rate at which customers or subscribers stop doing business with a company over a specified period. Typically expressed as a percentage, businesses track the customer churn rate by comparing the number of lost customers against the total customer base within a given timeframe. This metric is generally reported on a monthly basis, and while reducing churn rate is a universal goal, it’s crucial to recognise that churn rates vary significantly across industries. A deeper understanding of your specific market is key to implementing precise churn reduction strategies.

Why is Customer Churn the Most Important SaaS Metric?

For SaaS businesses, the customer churn rate is critical because recurring revenue forms the foundation of the subscription model. Acquiring customers is costly, especially in subscription-based businesses. Before delving into acquisition costs, it’s important to understand why SaaS companies depend so heavily on recurring revenue and how customer success plays a vital role in reducing churn.

SaaS Businesses Depend on Recurring Revenue

Monthly Recurring Revenue (MRR) is the lifeblood of SaaS companies. The ability to predict and sustain revenue over the long term depends on keeping churn under control. On the other side, tracking churn indicators, such as churned MRR, gives businesses insight into how customer churn rates impact overall growth. A rapid loss of customers can stifle your ability to scale, making it vital to focus on reducing churn rates.

It’s Cheaper to Retain Customers than Acquire New Ones

Customer Acquisition Cost (CAC) is a pivotal metric for any SaaS business. CAC represents the total expenditure on sales and marketing efforts needed to acquire a customer. One of the best indicators of a scalable, profitable business is the relationship between CAC and Customer Lifetime Value (LTV). Low CAC combined with high LTV reflects strong customer satisfaction and retention. Not only does it cost less to retain customers, but enhancing their experience also leads to long-term growth. Churn reduction strategies focused on improving the customer journey are far more cost-effective than acquiring new clients.

Improving Customer Engagement: An Underrated Revenue Channel

Focusing solely on acquisition is a costly mistake. Engaging existing customers is a powerful revenue driver, often overlooked. Retaining current customers and offering them additional value is far more profitable than chasing new prospects. After all, your existing clients are already familiar with your product, which means they’re more likely to invest in upgrades or additional features. By implementing churn reduction strategies that focus on upselling and improving the user experience, you create a more profitable customer base while also addressing key churn indicators.

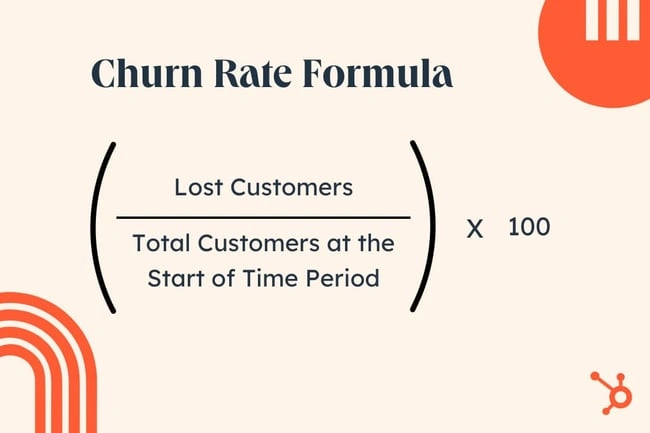

How do you calculate customer churn rate

The simplest formula for calculating the customer churn rate involves dividing the number of lost customers by the total number of customers over a specific period.

Customer Churn Rate=Number of Churned Customers/Total Number of Customers

However, this basic calculation only scratches the surface. To fully understand the impact of churn on your business, building a more comprehensive model is essential. More advanced statistical analysis and formulas provide greater insights, offering a clearer picture of both historical churn and future projections. The right model depends on factors like your company size, sample size, and long-term objectives, all of which play a part in defining your approach to reducing churn rates.

By adhering to these tailored churn reduction strategies, SaaS businesses can not only better understand their churn indicators but also take proactive steps to mitigate customer loss and enhance revenue stability.

Predictive Churn Modelling

After conducting a basic churn calculation, building a predictive churn model is the logical next step. Predictive modelling enables businesses to anticipate which customers are at risk of leaving, allowing for proactive intervention to prevent them from churning. By incorporating this model, companies can forecast future revenue losses by identifying churn indicators—such as reduced engagement or declining product usage—and developing tailored churn reduction strategies. The model also accounts for potential losses in Monthly Recurring Revenue (MRR), providing a clearer picture of how the customer churn rate might impact long-term financial stability.

What Matters Most?

From our experience, understanding the reasons behind customer churn is pivotal for developing proactive retention strategies. Prioritising value creation fosters loyalty, as customers are more inclined to stay when they perceive long-term benefits. Additionally, addressing pain points through a comprehensive customer journey map enables organisations to identify and resolve issues that might lead to churn, ensuring a smoother experience and deeper connections with clients.Get In Touch

What is the difference between customer churn and customer attrition

In today’s data-driven environment, understanding customer and employee behaviours is crucial for any business. Two metrics often discussed in this context are the customer churn rate and the attrition rate. While both refer to losses—customers or employees—each serves a distinct purpose. Grasping the differences between these metrics is essential for making informed decisions and improving retention across both fronts. Let’s delve into the specifics of churn indicators and attrition metrics to clarify how they influence a business’s ability to retain customers and employees alike.

What is Attrition Rate?

Unlike the customer churn rate, the attrition rate refers to the rate at which employees leave a company. This figure is critical for understanding turnover within an organisation and provides insight into company culture, leadership, and employee satisfaction. Attrition rate is calculated by dividing the number of employees who have left during a specific period by the average number of employees over that time.

Monitoring the attrition rate is vital as high turnover can signal deeper issues within a company, such as ineffective management, limited career development opportunities, or even a toxic work environment. On the other hand, low attrition rates can suggest strong leadership, a positive workplace culture, and high employee satisfaction. Analysing this data allows businesses to develop strategies for improving employee retention, including creating a more engaging work environment, fostering professional growth, and promoting positive internal relationships.

The Relationship Between Churn Rate and Attrition Rate

Both churn rate and attrition rate are important metrics for any business to track, but they apply to different areas. Customer churn rate is focused on the retention and loyalty of customers, offering insights into the effectiveness of acquisition and churn reduction strategies. In contrast, attrition rate measures employee turnover and reveals the strengths or weaknesses of a company’s internal processes, such as onboarding, training, and career development.

One notable difference is that churn indicators for customers vary across industries. For example, in the telecommunications sector, reducing churn rates is a priority as customers can easily switch providers. The churn rate serves as a key performance metric, reflecting customer satisfaction and loyalty. Similarly, in the SaaS industry, churn rate is a crucial measure of how many users choose not to renew their subscriptions.

In contrast, attrition rate focuses on employee retention and satisfaction. Businesses use this data to evaluate how well they manage human resources, identifying problem areas in employee engagement, development, and satisfaction. By understanding both metrics, companies can create more effective retention strategies, ensuring both customer satisfaction and employee loyalty.

Source: BIA Advisory Services

What is a Good Churn Rate?

Churn is an unavoidable reality for any subscription-based business. Even minor fluctuations in customer churn rate can significantly affect both current and future recurring revenue streams.

It’s important to distinguish between churn and turnover. Churn specifically refers to customers or subscribers who either voluntarily cancel their service or fail to pay and are therefore involuntarily removed from your customer base. On the other hand, turnover refers to the total revenue generated from your business’s goods and services over a set period. While turnover directly links to profit generation, churn is rooted in customer behaviour and retention issues.

So, when exactly do you count a customer as churned? While this can be defined differently depending on the business model, a common approach involves marking a customer as churned once their subscription period ends after cancellation, or when a subscription has not been renewed.

What is a reasonable churn rate for a subscription business

In the SaaS industry, the average customer churn rate can vary, but a good annual benchmark sits between 5-7%, with a 4% monthly churn rate often regarded as optimal. However, churn indicators and acceptable rates will differ across industries, and it’s essential to look at sector-specific benchmarks when assessing the health of your churn metrics. Knowing the average churn rates for your market allows you to adjust your churn reduction strategies more effectively.

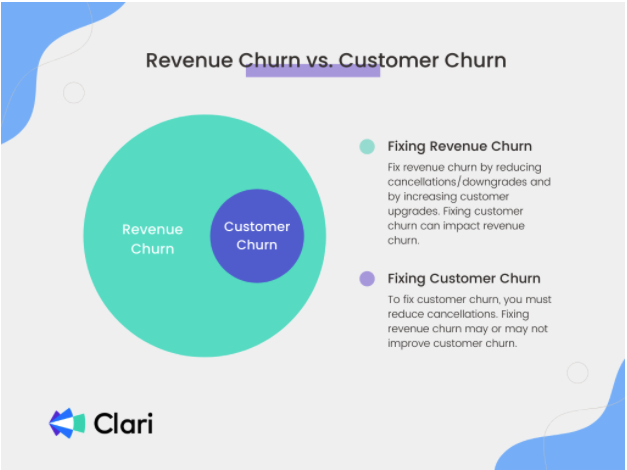

How to Minimise Business Churn Rates: Voluntary vs Involuntary Churn

Understanding the nature of churn is crucial, as different factors cause different types of churn, each requiring tailored solutions. Voluntary churn typically stems from dissatisfaction with the product or service, leading customers to cancel their subscriptions. In contrast, involuntary churn occurs when payments fail, often due to expired cards or other billing issues.

Improving the overall customer experience plays a significant role in reducing churn rates related to voluntary cancellations. This involves listening to customer feedback, optimising user journeys, and ensuring continuous value delivery. On the other hand, managing involuntary churn requires robust billing decline management strategies, such as card updaters and intelligent retries, to ensure that customers don’t leave due to technical payment issues.

Recent data shows that 42.2% of Recurly’s customers reduced their customer churn rate compared to the previous year, with involuntary churn being the primary target for reduction in 58.4% of cases. By employing sophisticated churn management techniques—such as dunning management and recovery events—Recurly managed to save 72% of at-risk subscribers, leading to an 8.6% revenue lift in the first year for these merchants.

Moreover, 44.1% of businesses saw a decrease in voluntary churn over the same period, underscoring the importance of addressing both voluntary and involuntary churn to create effective churn reduction strategies. By refining both aspects, businesses that rely on recurring revenue can significantly reduce overall customer turnover, paving the way for long-term growth.

How to Optimise Your Customer Churn Rates

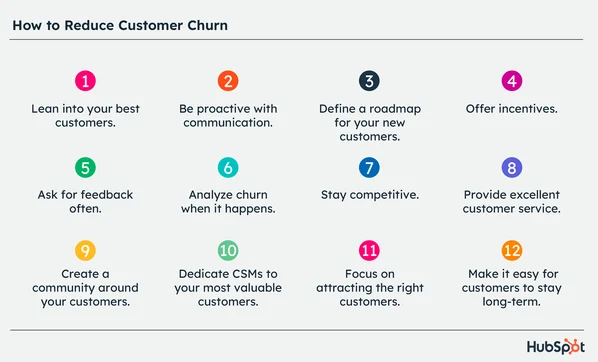

Engage with Your Customers

A fundamental strategy for reducing churn rate is to maintain active engagement with your customers. By embedding your product or service into their daily workflow, you create ongoing value that reinforces their commitment to your brand. This is where relationship marketing comes into play: consistently providing tangible reasons for customers to return to your offering.

But how can this be achieved in practice?

Start by sharing regular, versatile content that highlights the functional benefits of your product. This can include product updates, tips for optimising usage, or even special offers and upgrades. Regular communication is key, whether through newsletters, personalised offers, or product announcements. The more touchpoints you create, the more integrated your product becomes in the customer’s routine.

Engaging your customers on multiple channels—whether through email, social media, or in-app messaging—ensures that you remain top of mind and actively reduce customer churn rates.

Identify At-Risk Customers

The best way to manage churn is to prevent it from happening in the first place. Every business has a segment of customers that are more likely to churn than others, and identifying these at-risk customers early can make all the difference. Once identified, targeted outreach can be employed to retain them.

In fact, 35% of B2B organisations use at-risk customer identification as a primary tactic for reducing churn. Spotting these churn indicators isn’t as difficult as it may seem. It could be as simple as identifying customers who haven’t interacted with your product in a while, those who’ve requested additional information but haven’t converted, or those who haven’t responded to recent communications.

By analysing the behaviours of customers who’ve churned in the past, you can also predict who might be next. Recognising patterns in engagement—or lack thereof—provides valuable insight for proactive intervention and helps refine your churn reduction strategies.

Source: Smile.io

Conduct a Thorough Churn Analysis

To effectively combat churn, businesses must continuously analyse the reasons behind it. A variety of tools and methods can be employed to monitor industry trends and customer behaviours, helping you stay ahead of the curve.

For example, tools like Google Trends enable you to track patterns in customer purchasing behaviour and stay informed about broader industry movements. If you notice a dip in searches related to your product category, it’s a signal that your marketing or engagement efforts may need adjusting.

Moreover, collecting feedback directly from customers through exit-intent surveys and churn surveys provides a wealth of actionable insights. Tracking short-term customer satisfaction through Customer Satisfaction (CSAT) surveys allows you to identify issues before they escalate into churn. Incorporating Voice-of-the-Customer (VoC) insights can guide improvements in both your product and customer journey, further contributing to reducing churn rates.

Monitor User Engagement

User engagement is one of the most powerful churn indicators available to businesses today. Tracking how customers interact with your product can reveal key insights into their satisfaction and potential to churn. Engagement metrics provide a direct view of how well your product is performing in meeting customer needs.

Key metrics to monitor include:

- Time on page: How long customers spend interacting with key parts of your product.

- Average session duration: How much time users are spending per session, which can indicate product relevance and stickiness.

- Pages per session: A measure of how much of your product’s functionality a customer is engaging with.

- Bounce rate: Identifies if users are dropping off without meaningful interaction.

- Exit rate: Highlights the pages or points where users disengage.

- Customer lifetime value (LTV): Provides insight into the long-term value each customer brings to your business.

Personalised and Proactive Communication

Building lasting relationships with your customers requires more than just reactive communication; it demands personalisation and foresight. Reaching out to customers with tailored messaging, before they even realise they need assistance, demonstrates your commitment to their experience. This approach is crucial for enhancing loyalty, particularly as 71% of customers now expect a personalised experience.

Regularly updating customers with value-driven content—whether it’s product updates, special offers, or industry insights—helps keep them engaged and transforms them into brand advocates. This proactive approach is a cornerstone of any effective churn reduction strategy.

How to Execute Personalised and Proactive Communication

There are numerous tools available to help businesses deliver personalised outreach at scale. Platforms like Yieldify and Google Optimize allow you to segment your audience and send targeted communications based on behaviour and interaction history. By integrating with tools like Hotjar, you can also conduct A/B tests to refine your strategy, gaining deep insights into which elements drive engagement.

Analysing heatmaps of your website or landing pages can further reveal which personalised features prompt users to take action, allowing you to fine-tune your messaging and design. Personalised emails based on customer purchase history or previous interactions are another effective method for maintaining interest. For example, after a user signs up for your SaaS product, sending a follow-up email that highlights other features can enhance product adoption, engagement, and ultimately, reduce churn rates.

Account Updaters

One technical solution for reducing churn rates related to involuntary customer loss is the use of account updaters. This service works by automatically verifying and updating customers’ card details with their issuing banks before each renewal cycle. SaaS companies that utilise account updaters typically see a recovery rate improve by 2 to 5 times, which can make a substantial difference in overall retention.

Our Tactical Recommendations

Implementing regular feedback loops with customers helps refine products and services, significantly reducing the likelihood of churn. Clients often discover that a strong onboarding process is essential, as it sets the right expectations and enhances initial satisfaction. Moreover, using data analytics to predict potential churn allows organisations to intervene timely, addressing concerns before they escalate, thereby preserving customer relationships and loyalty.Get In Touch

Pitfalls When Trying to Optimise Customer Churn Rates

Poor Communication

A lack of clear communication is one of the most significant contributors to a high customer churn rate. Often, this issue arises right from the start during the onboarding process. During the sales phase, customers are in regular contact with attentive team members who are invested in solving their concerns and ensuring the deal closes successfully. However, the handoff from sales to implementation can sometimes leave customers feeling abandoned.

Does your implementation team engage immediately after the sale? Is there a clear roadmap for onboarding? Do customers know their responsibilities, as well as those of your team, and how both sides will work together to achieve a successful go-live? If not, this is a common misstep that can damage the customer relationship before it’s had a chance to flourish.

Effective communication during onboarding and beyond is essential for reducing churn rates. Clear, ongoing updates and structured processes help to keep the customer engaged and confident in the partnership.

Failure to Identify Problems Early

Securing customer loyalty is particularly challenging in competitive markets, and this is exacerbated by the high expectations customers now place on service providers. Research shows that more than half of customers will leave a provider after several negative experiences, and nearly 20% will churn after just one bad experience.

Waiting until a customer is dissatisfied to take action is often too late. Proactively identifying and addressing issues before they escalate is a critical churn reduction strategy. The best place to begin is with your onboarding process. Walk through each step from the customer’s perspective. Are there unclear instructions, confusing workflows, or points where communication breaks down? Rectifying these issues early ensures your customers don’t encounter unnecessary friction, improving overall satisfaction and reducing the risk of churn.

Lack of Transparency

Successful customer relationships are built on partnership, and transparency plays a vital role in that. Customers need insight into certain operational aspects of your business to fully benefit from your product, especially during the onboarding phase. A clear understanding of the implementation process, including responsibilities and timelines, ensures that customers know what to expect and how to measure progress.

However, many companies mistakenly keep their processes hidden, believing that shielding customers from potential mistakes protects the relationship. In reality, this often backfires, leaving customers feeling confused or undervalued. Lack of transparency creates a disconnect between expectations and reality, which is a major churn indicator.

Instead, consider taking a more transparent approach. Offer your customers a clear, step-by-step view of how the implementation will unfold, and involve them in key decision points. This builds trust and helps reinforce the value of your product, significantly reducing churn rates.

Your Customers No Longer See the Value in Your Product

Budget constraints are a fact of life for every business. Companies are willing to spend on products that they see as essential to their operations—what we might call a “painkiller” solution. However, if your product is perceived as a “vitamin,” something that’s nice to have but not critical, you run the risk of it being cut when budgets are reviewed.

Once your product is no longer viewed as an essential part of a customer’s operations, its position is precarious. It’s critical to continuously demonstrate the real value your product delivers, through data-driven insights, success stories, and proactive engagement that reminds your customers why they initially chose your solution. By consistently reinforcing this value, you can prevent your product from being viewed as expendable, and ensure that you stay ahead of potential churn risks.