Have you ever wondered if your startup is missing out on hidden revenue streams? While your core business might be thriving, there’s a wealth of untapped potential lying just beneath the surface. Imagine being able to unlock new income sources that not only complement your primary offerings but also drive significant growth.

That’s the promise of ancillary revenue—a powerful strategy that successful startups are leveraging to boost their earnings and secure their future. In this post, we’ll explore how you can identify and implement ancillary revenue streams, with practical examples and actionable insights to guide your journey. Ready to discover what your business might be missing?

- Ancillary revenue is a critical component for startups aiming to diversify their income streams and enhance financial stability.

- Identifying potential ancillary revenue opportunities requires analysing customer needs and market trends, ensuring alignment with your core business.

- Successful implementation of ancillary revenue strategies can significantly boost your startup’s overall earnings, as demonstrated by real-world examples.

- Integrating ancillary revenue streams into your business model involves a structured approach, focusing on seamless integration with your primary offerings.

- Overcoming challenges such as resource allocation and customer perception is crucial for the successful development of ancillary revenue streams.

- Utilise tools and technologies designed to support and optimise ancillary revenue initiatives, making the process more efficient and effective.

- Measuring the success of your ancillary revenue strategies through key metrics and KPIs ensures ongoing optimisation and growth.

What is Ancillary Revenue?

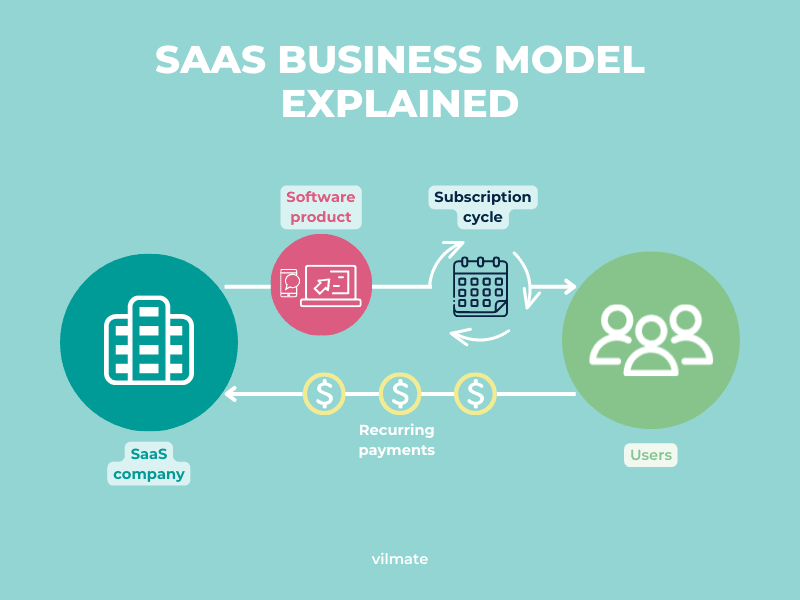

Ancillary revenue refers to the income a company earns from products or services that are not part of its primary offerings. By diversifying into new markets or enhancing existing products, businesses can unlock additional growth opportunities and ancillary profits.

Enhancing Ancillary Revenue

Many companies generate ancillary revenue through various innovative approaches. These streams can range from offering additional services at petrol stations, like car washes, to placing advertisements on aeroplanes. Sometimes, ancillary revenue streams can grow to become a significant part of the company’s total income.

For example, petrol stations initially treated snacks and beverages as secondary products. However, as petrol prices decreased, the sale of these items in petrol station stores increased, eventually surpassing petrol sales. This shift illustrates how ancillary revenue can sometimes overtake the primary income source.

Different industries continuously explore ways to boost their ancillary income. In the banking sector, although the primary revenue comes from interest on loans and credit products, banks also earn ancillary revenue from wealth management, wire transfers, and equipment leasing services.

Illustrative Examples of Ancillary Revenue

Consider a liquor store. While the main revenue comes from liquor sales, the store can also sell supplementary items like cigarettes, lighters, and shot glasses. These additional items contribute to ancillary profits, helping to grow the store’s overall revenue beyond its primary product sales.

A contemporary example is 7-Eleven convenience stores. Known for their extensive range of everyday items, 7-Eleven launched their own affordable cosmetics line in 2017. Although cosmetics might not replace their primary revenue sources, they have quickly become a notable ancillary revenue stream for the chain. This initiative highlights the company’s strategy to diversify and increase sales by introducing products that consumers are likely to purchase during their convenience store visits.

What Matters Most?

The most successful B2B companies focus on using ancillary revenue to extend long-term customer value. Aligning ancillary offerings with solving future problems can deepen trust and engagement. Typically, this requires a shift from transactional sales to a relationship-driven approach, where we consistently map the buyer journey to ensure every touchpoint offers value. Ancillary products should also fit into a broader customer lifecycle, addressing evolving needs over time, which we often see in thriving ecosystems that prioritise continued relevance.Get In Touch

Types of Ancillary Revenue

Understanding the various types of ancillary revenue streams is crucial for businesses aiming to diversify their income and maximise ancillary profits. Here are some common types of ancillary revenue:

#1 – Additional Services

Additional services are supplementary offerings that accompany a primary service. For instance, a carpenter might provide furniture building services as their main offering but could also offer design services for an extra fee. These design services, though not the primary service, can often be more profitable and contribute significantly to ancillary revenue streams.

#2 – Seasonal Sales

Seasonal sales involve selling products that are in demand during specific times of the year. This type of ancillary revenue can be particularly lucrative as it adds to the primary income without much overlap. For example, a vendor might set up a candy stall at a Christmas fair. While candy is not their main product, the revenue generated during the festive season can provide a substantial boost to their overall earnings.

#3 – Kiosks and Vending Machines

Leasing small areas for kiosks or vending machines within a company’s premises is another effective way to generate ancillary revenue. These setups not only provide additional income from the rental space but also enhance the services offered to employees and visitors. For instance, placing vending machines in strategic locations within an office complex can yield steady ancillary profits.

#4 – Additional Schemes

Occasional marketing schemes can also drive ancillary revenue. These schemes often involve limited-time offers or promotional stunts that attract additional customers. For example, offering a free umbrella with the purchase of winter clothing can generate extra income for both the umbrella seller and the winter wear retailer. Such promotions also benefit other marketers who gain exposure through collaborative marketing efforts.

How to Increase Revenue from Ancillary Products

Diversify Product Training

Unlocking the hidden potential of ancillary revenue streams starts with ensuring your sales representatives are well-equipped. While your reps may be proficient in selling your core products, boosting ancillary profits requires them to be just as knowledgeable about your ancillary items. Customers won’t buy products if they are unaware of them. Enhance product training so your sales team can proactively introduce these products to clients. Utilising videos from suppliers and vendors can help reps become conversant in the features and benefits of ancillary items.

Proactive vs. Reactive Sales

Ancillary products, such as disposable gloves, often fall into the category of reactive sales—they’re offered only when a customer requests them. Shift this dynamic by prepping your team to present these products during regular sales conversations. One effective strategy to achieve this is anchoring.

Anchor Your Product

Anchoring involves linking your ancillary products to the daily operations of your customer’s business. Many ancillary items are essential or highly beneficial when used alongside your main products. For example, disposable gloves are necessary when handling chemical solvents or lubricants. Establishing this connection helps customers understand the value of regularly stocking these ancillary items.

Begin the conversation by presenting both your core product and the relevant ancillary product. Illustrate how the core product they already purchase necessitates the use of the ancillary product. For a successful anchoring argument, ensure your sales representatives have the appropriate props to demonstrate this relationship.

Digital Marketing

Increasing awareness of your ancillary products also involves leveraging digital channels. Encourage new and existing customers to follow you on social media to stay updated with new offerings and exclusive promotions. Digital platforms can amplify your anchoring and sales techniques to a broader audience. Invite followers to engage with your business by calling your office, visiting your eCommerce store, or stopping by your physical location. Unsure where to start with digital marketing? Begin by integrating these strategies to create a cohesive online presence that highlights your diverse product offerings.

Our Tactical Recommendations

The most impactful tactical moves centre around personalisation and timing. Clients often find that deeply personalised ancillary offers based on specific insights can turn previously overlooked touchpoints into high-value moments. We typically see success when sales and marketing teams collaborate to co-develop narratives around ancillary services, making the offer feel natural rather than forced. Additionally, leveraging content loops to continuously promote the value of ancillary services keeps them top of mind for clients, enhancing retention and maximising revenue over time.Get In Touch

What pricing strategies are effective for ancillary products?

Competitive Analysis for Pricing Insight: Start by conducting a thorough competitive analysis. This involves understanding how similar services are priced within the market. Gaining insight into market demand, perceived value, and the uniqueness of your ancillary revenue streams is crucial. Pricing isn’t just about covering costs; it’s about strategically positioning your service to attract and retain customers while maximising ancillary profits.

Dynamic Pricing Models: Adopt dynamic pricing models to remain agile in a fluctuating market. This approach allows you to adjust prices based on real-time market conditions, customer demand, and other external factors. For instance, you might lower prices during off-peak seasons to maintain sales momentum or increase them when demand spikes. Dynamic pricing keeps you responsive and relevant, ensuring your ancillary revenue streams remain robust.

Tiered Service Levels: Offer tiered service levels to cater to a diverse customer base. This strategy involves creating different pricing tiers with varying levels of service or features. For example, a basic package could offer essential features, while premium tiers could include advanced functionalities or personalised support. This approach broadens your market appeal and allows customers to choose a level that best fits their needs and budget, enhancing your ancillary profits.

Value-Based Pricing: Implement value-based pricing where the price is determined by the perceived value to the customer rather than just the cost of service. This strategy requires a deep understanding of how customers perceive the value of your ancillary revenue streams. For instance, if your service saves customers time or significantly enhances their operations, you can justify a higher price, reflecting its true value.

Psychological Pricing Tactics: Utilise psychological pricing tactics to make your prices more attractive. For example, pricing a service at £99 instead of £100 can make a significant difference in customer perception. This strategy leverages consumer psychology, where slightly lower prices appear much more appealing, thereby increasing the likelihood of purchase and boosting your ancillary revenue.

What challenges do businesses face when implementing ancillary revenue strategies?

- Addressing Integration Issues: One of the primary challenges in implementing ancillary services is ensuring seamless integration with existing systems. Businesses need to develop solutions that can easily integrate with various platforms and technologies. For example, creating APIs that allow for easy integration can significantly reduce implementation barriers for clients.

- Managing Resource Allocation: Expanding into ancillary services often requires additional resources. Companies must strategically allocate their resources, balancing the development of new services with the maintenance of core offerings. This might involve hiring new talent with specific expertise or reallocating existing staff to focus on high-potential ancillary projects.

- Overcoming Market Resistance: Introducing new services can sometimes be met with scepticism or resistance from the market. To overcome this, businesses should focus on building strong value propositions and demonstrating the tangible benefits of their ancillary services. Engaging with early adopters and leveraging their testimonials can be an effective way to build credibility and trust.

- Ensuring Quality Control: As companies expand their service offerings, maintaining quality becomes increasingly challenging but essential. Implementing rigorous quality assurance processes and continuously gathering customer feedback can help ensure that the new ancillary services meet the high standards expected by clients.