Is your business struggling with customer churn? Watching customers leave, especially when you’ve invested so much in acquiring them, can be both disheartening and financially damaging. Yet, the reality is that many businesses face this challenge, often without fully understanding why it’s happening or how to stop it. But what if you could turn things around?

What if you could not only reduce churn but also build stronger, more loyal customer relationships in the process? The key lies in identifying the root causes of churn and implementing targeted strategies to address them. In this guide, we’ll explore the critical factors that drive customer churn and provide you with actionable strategies to reduce it.

From understanding customer behaviour to leveraging data-driven insights, you’ll discover how to create a customer retention plan that not only keeps your clients happy but also ensures your business thrives.

- Understand the Root Causes of Churn: Identifying why customers leave is the first step in reducing churn. Focus on gathering and analysing customer feedback to uncover recurring pain points.

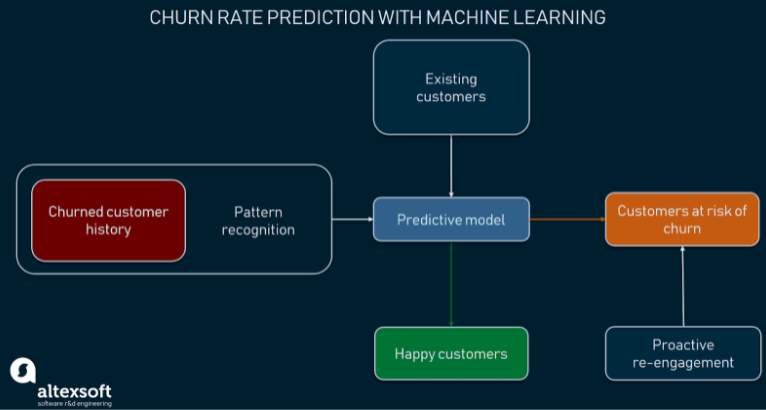

- Leverage Data-Driven Insights: Use customer data to predict churn risk and tailor your retention strategies accordingly. This approach enables you to proactively address issues before they lead to churn.

- Implement Personalised Retention Strategies: Tailor your retention efforts to individual customer needs and preferences. Personalisation can significantly enhance customer satisfaction and loyalty.

- Enhance Customer Experience: A positive customer experience is crucial for retention. Streamline processes, improve communication, and ensure that your product or service consistently meets customer expectations.

- Measure and Optimise Retention Efforts: Continuously track the effectiveness of your churn reduction strategies. Use metrics such as customer satisfaction scores and retention rates to refine your approach and achieve better results.

- Focus on Long-Term Relationships: Building strong, long-lasting relationships with customers is key to reducing churn. Invest in customer success initiatives that foster trust and loyalty over time.

What steps should I take to calculate my business’s churn rate?

Imagine a long-term customer who has supported your business from the beginning, but suddenly, they decide to leave. This phenomenon, known as customer churn or customer attrition, occurs when a customer ceases their relationship with your business. Understanding customer churn is vital for effective churn management and customer churn reduction.

Customer churn is measured using the churn rate, which is the number of customers who stopped their association with your business during a specific period, such as a year, a month, or a financial quarter. Grasping this rate is crucial for effective churn management and customer churn reduction.

While some customer churn is inevitable, expecting 100% customer retention over several years is unrealistic. However, if your churn rate is excessively high or exhibits an upward trend, immediate action using proven churn reduction techniques and proactive churn management is necessary.

How to Calculate Churn Rate

To calculate your company’s churn rate, select a period you wish to measure and identify the following values:

- Number of customers at the start of the period (X)

- Number of customers lost during that period (Y)

Then, use the following formula to determine your customer churn rate (Z) as a percentage: Customer churn rate formula: (Y/X)×100=Ztext{Customer churn rate formula:} (Y/X) times 100 = ZCustomer churn rate formula: (Y/X)×100=Z

For example, if a business began the month with 100 customers and lost 10 by the end, it would have a monthly churn rate of 10%.

This straightforward formula applies to any time frame, whether a year, a month, or even a day. However, businesses might face situations requiring more complex churn rate calculations for precise churn management.

The Importance of Churn Rate Calculation

Understanding and calculating your churn rate is the initial step towards effective churn mitigation and customer churn reduction. Implementing proactive churn management strategies helps maintain a stable customer base and ensures long-term business success. Regularly monitoring and analysing your churn rate enables you to identify trends and take timely corrective actions, employing proven churn reduction techniques to retain customers and foster loyalty.

What Matters Most?

When teams collaborate effectively, they can spot early churn signals and react before the customer disengages. Clients often discover that their differentiation strategy—offering a unique product experience—plays a crucial role in retention, as it prevents customers from switching to competitors easily. Additionally, reinforcing the product’s value throughout the customer lifecycle typically strengthens customer trust and reinforces their decision to stick with your solution. From our experience, these elements collectively create a strategic buffer against churn.Get In Touch

Causes of Customer Churn

Attracting the Wrong Customers

It’s remarkable how often customers sign up for a product without fully grasping if it meets their needs. Once they realise the product is not a great fit, they are likely to switch to a competitor, affecting your churn management efforts significantly.

Solution: Ask the Right Questions Upfront

Preventing churn due to poor customer-product fit necessitates a deep understanding of your customers’ needs. Ensure your messaging highlights the problem your product solves rather than just its features. This proactive churn management approach is essential for effective churn mitigation.

Customer Support Needs Improvement

When issues arise, customers do not want to wade through a confusing knowledge base or interact with a bot. They desire real people who can assist them in resolving their problems. Poor customer service often leads to high churn, requiring immediate action for customer churn reduction.

Solution: Make Customer Support a Priority from the Start

Prioritising exceptional customer support can distinguish your brand and aid in customer retention. If feasible, provide live support and treat it as a profit centre. For smaller businesses without a dedicated customer service team, set clear expectations about support availability. Managing customer expectations through tiered support levels with varying SLAs can significantly enhance your churn management strategy.

Customers No Longer See Value in Your Product

Maintaining a tight budget is vital for a successful business. Companies are willing to invest in products they view as essential (a “painkiller”) rather than non-essential extras (a “vitamin”). If your product is perceived as the latter, it risks being discarded, necessitating proven churn reduction techniques.

Solution: Position Your Company as a Painkiller

To manage and predict churn effectively, ensure every customer perceives your product as indispensable—a painkiller. Track customer satisfaction over time through surveys to understand what your customers truly value and where improvements can be made. Net Promoter Score (NPS) surveys are an excellent starting point for proactive churn management and churn mitigation.

How can I identify customers who may be at risk of churning?

Understanding the causes of customer churn is the first step. Next, it is crucial to identify which customers are at risk. By implementing these proven churn reduction techniques, you can maintain a stable customer base and ensure long-term business success.

Support Ticket Data

The support ticket situation can be likened to a Goldilocks problem—you don’t want too many, you don’t want too few; you want the number to be just right for effective churn management and customer churn reduction.

- Low Number of Support Tickets: While it may seem positive to have few support tickets, it can indicate that the customer is unengaged and has not fully adopted your product. Instead of assuming they are highly competent users, it is more likely they have not invested the necessary time in the product. This could place your product on the budget chopping block, necessitating proactive churn management.

- High Number of Support Tickets: A high number of support tickets is a more obvious sign of an at-risk customer. Frequent ticket submissions can indicate dissatisfaction, numerous product issues, or difficulty in using your product. This situation requires immediate escalation to resolve issues quickly. Both scenarios present opportunities to provide additional education and training, essential for churn mitigation.

Website Activity

Utilising web tracking tools can reveal when customers view cancellation or downgrade pages—a clear sign they might be considering leaving your product, impacting customer churn reduction efforts.

If customers enquire about downloading their data, it may indicate plans to migrate away from your product. Even if no immediate action is taken to change their account status, this is a significant indicator that something is amiss, requiring proactive churn management.

Reach out to these customers to identify the underlying problem. Do they still perceive value in your product or service? Are they dissatisfied with your support team? Once you’ve identified the core issue, take steps to resolve it as part of your proven churn reduction techniques.

NPS Survey Results

Regularly surveying your customers provides the data needed to understand their satisfaction levels. When a customer gives a detractor (or even a neutral) NPS score, it is time to intervene for effective churn mitigation.

Pro Tip: If a customer doesn’t provide a reason for their low NPS survey score, check your online community. Often, you can piece together the backstory based on their community activity. This approach enables you to enter the conversation more informed and prepared with guidance, enhancing your proactive churn management strategies.

By implementing these techniques and carefully monitoring these signs, you can significantly improve your churn management, ensuring effective customer churn reduction and long-term business success.

What retention strategies can effectively reduce customer churn?

Retain Customers with a Smooth Onboarding Process

First impressions are crucial. After the initial excitement of acquiring a new product or service, customers often reflect on their first experience with your brand. A positive initial experience significantly enhances customer churn reduction and churn mitigation efforts.

A well-executed onboarding process is a key customer retention strategy that sets you up for long-term success. It should be as personalised as possible, hands-on, and focused on eliminating friction, thereby ensuring proactive churn management.

Source: Retently

Keep Your Products and Services Top of Mind

Marketing efforts should not cease once someone becomes a customer. In today’s competitive marketplace, maintaining visibility is essential for customer churn reduction.

You can achieve this through various customer retention strategies. Effective options include weekly email newsletters, social media contests, and high-value content such as blogs, videos, podcasts, or ebooks. These methods help keep your brand at the forefront of your customers’ minds.

Enhancing User Interface and User Experience

Delivering seamless and frictionless customer experiences is essential for fostering brand loyalty and retention. The two pivotal elements that determine the quality of these experiences are the user interface (UI) and the overall user experience (UX).

User Interface (UI): The UI encompasses the visual design and interactive components that facilitate customer tasks. Enhancements in UI might include:

- Improved Information Architecture: Organising content in a way that is easy to navigate.

- Intuitive Button and Icon Placement: Ensuring users can easily find and use interactive elements.

- Enhanced Error Message Feedback: Providing clear, helpful messages to guide users when something goes wrong.

User Experience (UX): UX covers the broader interaction a customer has with a product throughout their journey. Techniques such as user flows and journey mapping help identify pain points and moments of delight. Enhancements in UX could involve:

- Personalisation Features: Customising the experience based on user preferences.

- Frictionless Account Registration: Making sign-ups quick and easy.

- Engaging Onboarding Tutorials: Ensuring new users understand how to get the most out of the product.

- Seamless Navigation Across Devices: Providing a consistent experience on all platforms.

Regular usability testing is crucial for gathering customer feedback, allowing for continuous improvements in both UI and UX. This approach not only reduces friction and confusion but also significantly enhances retention by ensuring customers enjoy a smooth, pleasing experience at every touchpoint.

Implementing Effective Referral Programmes

Referral programmes are powerful tools for both acquiring new customers and retaining existing ones. They incentivise customers to promote the brand they love, driving higher conversion rates and reducing the cost per acquisition (CPA).

Beyond acquiring new customers, referrals serve as a vital retention strategy. When someone refers a friend or peer to a brand, it puts their social reputation on the line, signalling:

- Satisfaction: The product is valuable enough to recommend.

- Belief: The referrer trusts that their connections will have a similarly positive experience.

To leverage this social pressure effectively, optimise your referral programme with the following design elements:

- Attractive Offers: Provide free trials, discounts, or account credits.

- Integrated Channels: Ensure referral options are available via email, web, and social platforms.

- Automated Triggers: Make the referral process seamless and integrated into natural user flows.

- Gamification: Use compelling prizes, tiers, and leaderboards to motivate participation.

When executed well, referral programmes not only enhance customer churn reduction but also attract ideal new users through word of mouth, ensuring effective churn management and mitigation.

By implementing these proven churn reduction techniques, businesses can maintain a loyal customer base, reduce churn rates, and achieve sustainable growth through proactive churn management strategies.

Our Tactical Recommendations

We often see clients simplifying onboarding to tackle one of the most common causes of churn: user frustration in the early stages. Early engagement through clear, concise product training reduces friction significantly. Additionally, leveraging predictive segmentation to identify at-risk customers allows for targeted interventions before issues escalate. Frequent and subtle reinforcement of the product’s value through personalised post-sale messaging tends to keep customers engaged and less likely to churn—especially for companies with long sales cycles or SaaS models.Get In Touch

How can data analytics enhance my approach to managing customer retention?

Personalise Customer Experiences

Tailoring customer experiences is essential for bolstering customer loyalty and achieving effective customer churn reduction. This approach, driven by data, goes beyond simple customisation to deeply understand individual customer preferences and behaviours.

By leveraging data analytics, companies can decode the subtleties of customer choices, enabling brands to fine-tune the offerings in their loyalty programmes. Data-driven personalisation makes customers feel valued and understood, which is a cornerstone of effective churn management.

This personalisation transforms customer relationships, turning them into loyal brand advocates. For brands aiming to boost customer loyalty through proactive churn management and churn mitigation, this strategy is indispensable.

Leverage Technology to Maximise ROI

Brands don’t need to start from scratch; numerous technologies and platforms are available to support effective churn management. Using existing loyalty technologies can help brands build, revamp, and optimise their loyalty programmes more efficiently, maximising overall ROI.

An exemplary solution for brands is the Intelligent Loyalty Platform from Capillary Technologies. This comprehensive SaaS suite includes Loyalty+, Insights+, Engage+, CDP+, and Rewards+, integrating various tools to create a holistic loyalty management ecosystem. This approach ensures proven churn reduction techniques are effectively implemented, enhancing the overall effectiveness of your churn management strategies.

Predict Customer Interests

Harnessing the power of AI data analytics enables businesses to accurately predict customer interests by analysing vast behavioural datasets. By examining purchase history, browsing patterns, feedback, and more, predictive analytics can determine whether a customer is likely to be interested in additional or upgraded products or services. This insight allows for timely offers of discounts or rewards, which significantly aids in customer churn reduction.

Furthermore, AI data analytics can identify which products are likely to be the next purchase for a customer, thus enhancing your cross-selling strategy. According to a survey of 500 sales professionals, 72% who upsell and 74% who cross-sell report that these efforts contribute up to 30% of their revenue. This underscores a significant opportunity to maximise growth through effective churn mitigation. Tools like Pecan AI can pinpoint customers likely to purchase complementary or premium products and services, providing a solid foundation for effective churn management.

Support Your Customer Success Team

Customer success is pivotal to the overall customer experience. A PWC survey revealed that 8% of respondents would leave after a single bad experience, and 32% would terminate their relationship after inconsistent experiences. Thus, robust support for your customer success team is critical for effective customer churn reduction.

By channelling AI data analytics into valuable insights, you can empower your customer success teams to perform optimally and enhance customer experiences. This approach helps identify your most valuable customers early on. Tools like Pecan AI can provide customer lifetime value predictions, offering crucial insights for proactive churn management.

Key Tip: Leverage customer data to equip your customer success teams with tailored recommendations for product add-ons, features, or complementary services. Customers predicted to have high lifetime value (LTV) might warrant VIP service and increased attention. When a customer contacts customer success, representatives can use that individual’s information to recommend relevant items and offer the appropriate level of service at the right time.

By incorporating these strategies, you can leverage data analytics to enhance churn management, implement proactive churn management, and achieve substantial customer churn reduction.