Understanding your competitors’ strengths and weaknesses isn’t just beneficial—it’s essential. Whether you’re benchmarking your own performance or seeking gaps to exploit, a thorough competitive analysis can provide the insights needed to stay ahead.

This guide takes you through a step-by-step process to decode your competitors’ strategies, helping you gather critical data, analyse it effectively, and turn these insights into actionable strategies.

From identifying market leaders to uncovering vulnerabilities, you’ll learn how to build a robust competitor profile and leverage this intelligence to sharpen your strategic edge. Let’s dive into the practical steps you can take to outmanoeuvre your competition and secure your market position.

- Start with a Comprehensive SWOT Analysis: Begin by identifying your competitors’ strengths and weaknesses through a detailed SWOT analysis, which provides a clear framework for comparison.

- Leverage Competitive Intelligence Tools: Use tools like SEMrush and Ahrefs to gather actionable data on your competitors’ SEO performance, content strategy, and market positioning.

- Benchmark Against Competitor Strengths: Identify key areas where competitors outperform your business to set benchmarks that can drive your strategic improvements.

- Exploit Competitor Weaknesses: Recognise and target the gaps in your competitors’ offerings, allowing you to position your business more effectively in the market.

- Create Detailed Competitor Profiles: Build comprehensive profiles for each competitor, including their product offerings, pricing strategies, and customer feedback, to inform your strategic decisions.

- Apply Insights to Your Strategy: Use the intelligence gathered to refine your business strategy, improve your product offerings, and enhance your marketing efforts for better market alignment.

- Avoid Common Analysis Pitfalls: Regularly update competitor profiles and avoid underestimating rivals to maintain an accurate understanding of the competitive landscape.

What is the process for conducting a SWOT analysis on my competitors?

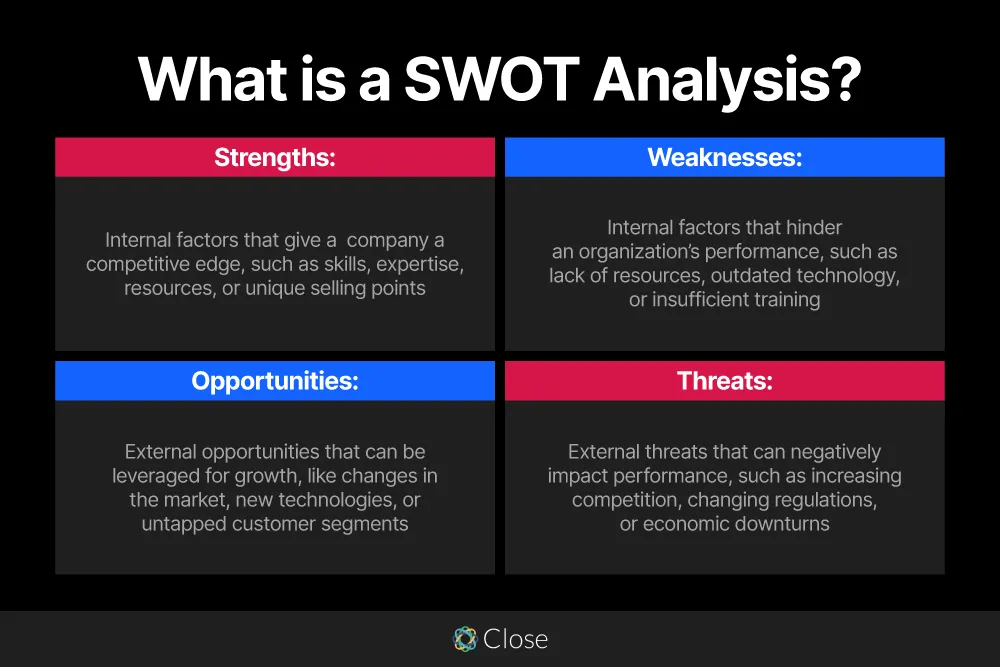

Competitor SWOT analysis is an essential decision-making tool used to gain a comprehensive overview of a current business situation before formulating a corporate strategy. SWOT, an acronym for Strengths, Weaknesses, Opportunities, and Threats, is a framework designed to evaluate both internal and external factors affecting your organisation or project. The internal factors include Strengths and Weaknesses, specific to your organisation, while Opportunities and Threats are external and depend on the broader environment. By creating a grid with four quadrants for each element and populating it with relevant data, you can gain instant insights into the context of your decision-making.

What Matters Most?

From our experience working with clients across industries, we’ve found that organisations often succeed when they focus on building community, something many competitors fail to nurture effectively. Competitors struggle with engaging customers beyond transactions, which leaves a gap for brands that can foster deeper, tribe-like relationships. Additionally, clients often discover that competitors frequently overlook the power of integrated sales and marketing—when these efforts aren’t unified, the result is misalignment that creates opportunities for those who can streamline and personalise touchpoints across the customer journey. Lastly, hyper-personalisation tends to be underutilised by competitors in account-based marketing, giving those who leverage it a chance to create standout, scalable ABM campaigns that drive real account growth.Get In Touch

How SWOT Analysis Reveals Competitors’ Strengths and Weaknesses

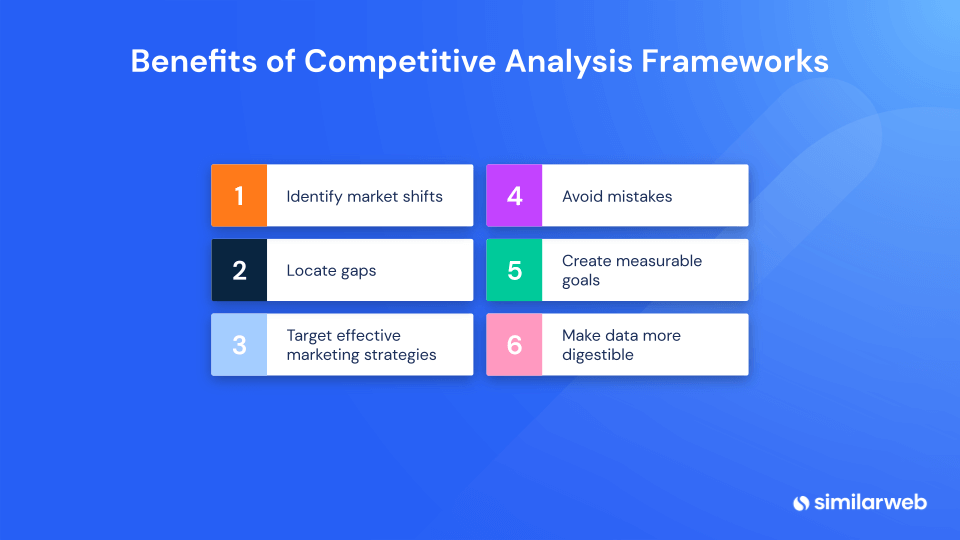

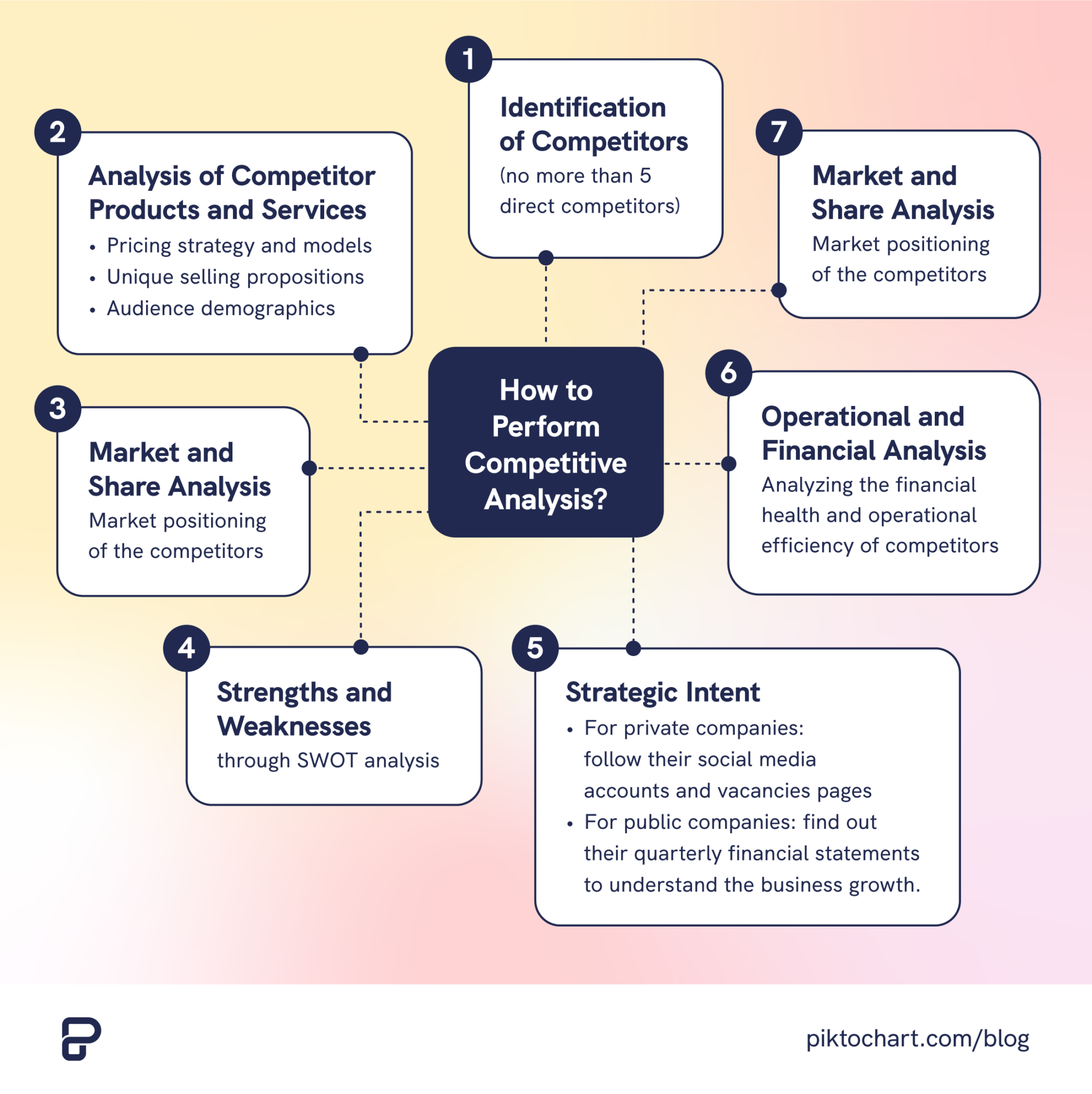

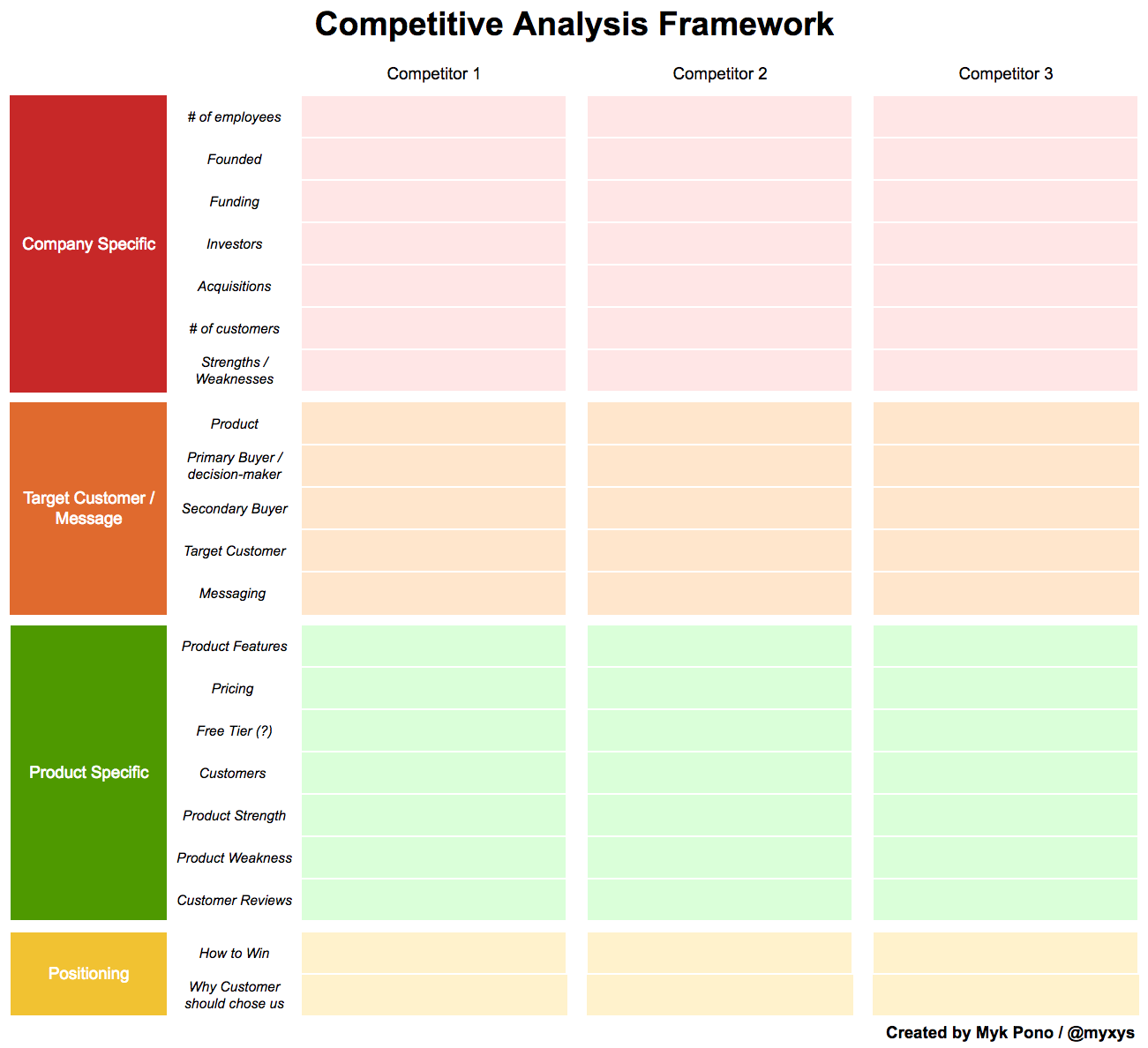

To avoid competitive blind spots, conducting a thorough and systematic b2b competitor analysis is crucial. Here is a streamlined approach to assess the competition and potentially gain an advantage:

- Determine Who Your Competitors Are: Identify your top three to five competitors. While you can expand this list later, initially keep it concise and focused.

- Create a Framework: Develop a document outlining the parameters to gain a comprehensive picture of your competitors. This will aid in analysing their offerings and positioning. Suggested fields to research include:

-

-

- Company name and website address

- Geographical locations

- Mission statement

- Brand positioning

- Products/services offered (including applications/markets targeted)

- Key benefits they stress

- Pricing

- Perceived strengths and weaknesses

-

-

- Define Your Competitor Research Methodology: Choose the best methods to gather the information needed to fill your competitor analysis framework, such as:

-

-

- Web-based research

- Mystery shopping

- Interviewing customers and other third parties

-

-

- Allocate Roles and Responsibilities: Competitor analysis is a time-consuming yet vital ongoing activity. Assign specific responsibilities from the outset, detailing what needs to be achieved, reporting methods, and deadlines.

- Research Competitors’ Finances and News Updates: Understanding your competitor’s profitability, growth methods, and potential mergers or acquisitions can be invaluable. For example, if a competitor recently acquired a smaller biotech company, significantly expanding their capabilities, you may need to adjust your strategy accordingly.

Carry Out Ongoing Competitor Monitoring

Consistent monitoring of your competition is essential to maintain a competitive edge. This should be an ongoing process. Here are some effective tips for staying updated on your competitors’ activities and gaining insights into their business practices and market communication strategies:

- Sign Up for Their Newsletters: Regular updates via newsletters can provide valuable insights into their latest offerings and strategies.

- Follow Their Blog: Subscribing to their blog ensures you stay informed about their thought leadership and industry perspectives.

- Engage on Social Media: Follow their social media channels to observe how they interact with their audience and promote their products or services.

- Set Up Google Alerts: Create alerts based on their company and brand keywords to receive real-time updates on their activities.

By integrating these monitoring practices, you can continuously update your competitor SWOT analysis, ensuring it remains relevant and actionable. This will help you effectively analyse the strength and weaknesses of competitors, understand competitors’ weaknesses, and leverage the strengths of competitors to your advantage.

How can I effectively monitor my competitors over time?

Step 1: Identifying Competitor Strengths

The initial phase of a SWOT analysis is pivotal, focusing on recognising the strengths of competitors. Without understanding these strengths, any strategy to outmanoeuvre competitors would be incomplete.

To evaluate the strengths of competitors, start by gathering detailed information about them. Begin with identifying both direct and indirect competitors:

- Direct competitors operate within the same industry and offer similar products or services.

- Indirect competitors provide substitute or alternative products.

Once you’ve identified your competitors, analyse what gives them a competitive edge. For instance, a competitor might have a loyal customer base or a diverse product portfolio that sets them apart.

After pinpointing these strengths, compare them with your business’s strengths. This comparison will reveal areas where your business may be lacking, highlighting where your competitors hold an advantage.

Understanding the strength of competitors allows you to develop similar strengths to remain competitive. Businesses often monitor their competitors’ strengths closely to emulate them.

Consider Apple and Samsung as an example. Apple accused Samsung of copying phone designs and features. The similarities between some iPhones and Samsung phones suggest that Samsung drew inspiration from Apple’s strengths and adopted similar features to compete effectively.

With the first step of the SWOT analysis—identifying the competitor’s strengths—complete, we move to the next phase.

Step 2: Revealing Weaknesses

The second step of the SWOT analysis is crucial for a comprehensive b2b competitor analysis. This stage involves identifying and analysing competitors’ weaknesses. Recognising these weaknesses allows your business to develop strategies to capitalise on them.

To identify competitors’ weaknesses, begin by collecting relevant data. For instance, if Honda were conducting a SWOT analysis on Toyota, they would need to pinpoint Toyota’s weaknesses. These might include limited global presence and outdated technology in their vehicles.

Once this information is gathered, compare it with your business’s weak points. This comparison highlights areas where the competitor is vulnerable and where your strengths lie, enabling you to form strategies to exploit these weaknesses.

For example, Toyota’s lack of innovation and technology, being years behind Tesla, represents a significant weakness. Honda could focus on advancing its technology to exploit this gap and gain market share.

Dove provides another excellent example of leveraging competitors’ weaknesses. While other beauty brands focused solely on product features, Dove highlighted real-life stories, targeting the emotional aspect and portraying internal beauty as paramount. This strategy capitalised on competitors’ lack of personal connection, significantly increasing Dove’s customer base.

Having thoroughly explored the strength and weaknesses of competitors in this step, we proceed to the third phase of the SWOT analysis, identifying growth opportunities.

Step 3: Exploring Opportunities

Source: McKinsey

Businesses should continuously look for ways to expand their customer base and increase their market share. Growth opportunities often arise from external environments, but only vigilant businesses can capitalise on them.

To explore these opportunities, research and analyse current and emerging market trends. For instance, the Japanese clothing brand Uniqlo gained a competitive edge by shifting from manufacturing conventional clothes to casual attire in the early 1980s, anticipating a market trend.

Monitoring political landscapes is also crucial, as many opportunities stem from political changes. For example, when Pakistan’s economic and political conditions declined, many textile manufacturers for Nike and Adidas moved operations to Bangladesh, benefiting from lower operational costs.

Conducting customer surveys is another key strategy. Staying connected with customers and understanding their needs helps businesses find opportunities to expand their customer base.

Analysing economically and demographically growing markets is also vital. The African market, for example, is emerging and offers significant investment opportunities. Businesses need to tap into these untapped economies to succeed.

Globalisation has created numerous opportunities for businesses to collaborate with major brands and celebrities worldwide. Furthermore, technological advancements continually provide new avenues for business expansion. The recent emergence of Artificial Intelligence (AI) has allowed businesses to reduce operational costs by automating processes.

Having thoroughly explored the third step of the SWOT analysis, let’s move on to the final step, which involves identifying threats.

Step 4: Identifying Threats

The final step of the SWOT analysis is essential as it focuses on identifying threats to businesses. Threats are dangers in the external environment that businesses must address.

Threats can manifest in various forms, including competitors, economic challenges, or market dynamics. To succeed, businesses must overcome these threats.

First, identify the types of threats existing in the market. If a business feels threatened by changing consumer preferences, it must develop strategies to address this issue. For example, the fashion industry faces constant challenges due to changing trends. Businesses in this sector must stay responsive to shifts in consumer preferences.

Economic challenges, such as a global recession, also pose threats to many businesses. In such cases, companies need to save sufficient funds to continue operations during financial downturns.

Some businesses see technological changes and innovation as threats. For instance, the emergence of AI has led to the replacement of human capital with AI. Businesses can address this threat by adopting the latest technologies to enhance efficiency and productivity.

At the conclusion of the SWOT analysis, businesses must identify and prioritise their threats to develop a coherent strategy to mitigate them.

By systematically analysing competitor strengths and weaknesses and the broader market landscape, businesses can craft strategies to navigate opportunities and threats, ensuring robust and sustainable growth.

Our Tactical Recommendations

From our experience, many competitors still overlook social listening as a tool for identifying their weaknesses—clients often realise too late that this can reveal gaps in customer satisfaction that your team can exploit quickly. By focusing on real-time conversational marketing, we often see that clients are able to address leads faster than competitors who don’t capitalise on speed. Another tactical area clients should explore is pinpointing where competitors are slow to act on customer feedback. This delay allows you to create more adaptive, responsive solutions that can win over dissatisfied competitor clients more effectively.Get In Touch

The Four Ps: Product, Price, Place, and Promotion

The concept of the four Ps, originating from Harvard in the 1950s, is crucial in understanding your competitors’ strengths and weaknesses. These four essential factors—Product, Price, Place, and Promotion—play a significant role in marketing a product or service to consumers.

- Product: Examine the quality and features of your competitor’s product. How does it compare to your offerings and the rest of the market? Assessing the strengths of competitors’ products will provide insights into their competitive edge.

- Price: Investigate how much your competitors are charging for their products. Do their prices vary depending on the channel partners? What is their discount policy? Understanding their pricing model can reveal both strengths and weaknesses.

- Place: Consider their geographic reach. Do they operate in the same areas as you? Do they have both online and brick-and-mortar locations? Analysing the strengths and weaknesses of competitors in terms of place helps you understand their market penetration and accessibility.

- Promotion: Look into their sales tactics and marketing campaigns. What is their social media presence like? By studying these aspects, you can gauge the effectiveness of their promotional strategies.

To gather information about the four Ps, put yourself in the shoes of a customer. Visit their stores in person or online, research their social media channels and website, and consider purchasing their products to compare quality, features, and pricing with your own offerings.

Rank Your Competitors on a Common Scale

Source: Forrester Research

Standardising the way you assess each competitor can provide an objective view of the market landscape. Create a matrix that scores your competition on common criteria, using a scale from one to ten, where ten is the worst and one is the best. For instance, if a competitor has an excellent returns policy frequently mentioned in online reviews, rate them highly in that area.

Approaching this matrix from the perspective of the consumer is essential. You may have a different opinion on a competitor’s product quality, but customer satisfaction is what truly matters. Customer perception significantly influences sales and brand preference.

By applying these tips, you can perform a thorough b2b competitor analysis, understanding the competitor strengths and weaknesses and leveraging these insights to refine your own strategies. Remember, it’s not just about recognising the strengths of competitors but also identifying competitors’ weaknesses and how you can exploit them to your advantage. This holistic approach will ensure you remain competitive and strategically agile in your market.

The Best Resources for Competitive Analysis

A comprehensive b2b competitor analysis is crucial for understanding your competitors and identifying both competitor strengths and weaknesses. Utilising effective tools and resources can significantly enhance your analysis. Here’s a detailed SWOT analysis template to guide you through the process:

SWOT Analysis Template

- Strengths:

-

-

- Core competencies and unique capabilities that give your company a competitive edge.

- Strong brand reputation and customer loyalty.

- Well-established distribution channels or supply chain networks.

- Talented and skilled workforce.

- Effective internal processes and efficient operations.

- Strong financial position and resources.

- Patents, intellectual property, or proprietary technologies.

- Existing customer base and strong relationships with clients.

- Positive company culture and employee morale.

-

- Weaknesses:

-

-

- Areas where your company lags behind competitors.

- Limited resources or funding constraints.

- Lack of market presence or brand recognition.

- Inadequate technological infrastructure.

- Skill gaps or talent shortages within the organisation.

- Inefficiencies in internal processes or operations.

- Product or service limitations.

- Poor customer service or support.

- Weaknesses in financial management or cash flow.

-

- Opportunities:

-

-

- Emerging market trends or shifts in consumer preferences.

- New market segments or geographic expansion opportunities.

- Advances in technology that can enhance your products or operations.

- Strategic partnerships or alliances with complementary businesses.

- Changes in regulations or government policies that create favourable conditions.

- Mergers or acquisitions that could expand your market share.

- Potential gaps in the market that your company can fill.

- Growing demand for sustainable or socially responsible products/services.

-

- Threats:

-

-

- Competitive pressures from existing or new market players.

- Rapid technological advancements that may make your offerings obsolete.

- Economic downturns or fluctuations.

- Changing customer demands or preferences.

- Shifting regulatory landscape or compliance requirements.

- Supply chain disruptions or raw material shortages.

- Negative publicity or damage to the company’s reputation.

- Potential legal or litigation risks.

-

By employing this SWOT analysis template, you can systematically evaluate the strength and weaknesses of competitors and your own organisation. This method provides a structured approach to identify opportunities and threats, thereby crafting a robust strategy to maintain a competitive edge