Have you ever considered how much value each customer truly brings to your business over their lifetime? Understanding Customer Lifetime Value (CLV) is the secret weapon behind some of the most profitable businesses today, yet it’s often overlooked. What if you could predict the long-term success of your business based on the loyalty and spending habits of your customers?

By mastering CLV, you can unlock new avenues for growth and significantly boost your profitability. In this post, we’ll explore how to calculate CLV, implement data-driven strategies, and use technology to optimise your customer relationships—ensuring that every customer interaction is an investment in your company’s future success.

- Understanding and optimising Customer Lifetime Value (CLV) is essential for long-term business profitability.

- Accurate CLV calculation relies on a combination of current and predictive metrics, which are crucial for informed decision-making.

- Boosting CLV can be achieved through strategies such as improving customer retention, increasing average order value, and leveraging cross-selling and upselling opportunities.

- Data analytics plays a vital role in segmenting customers and tailoring marketing strategies to maximise CLV.

- Personalised marketing and enhanced customer experience are key drivers of higher CLV.

- Overcome common challenges in CLV measurement by utilising the right tools and solutions.

- CRM systems and AI tools can automate CLV analysis, making strategy implementation more efficient.

- Integrating CLV into your broader business strategy ensures alignment with overall profitability goals.

What are the different types of Customer Lifetime Value and their significance?

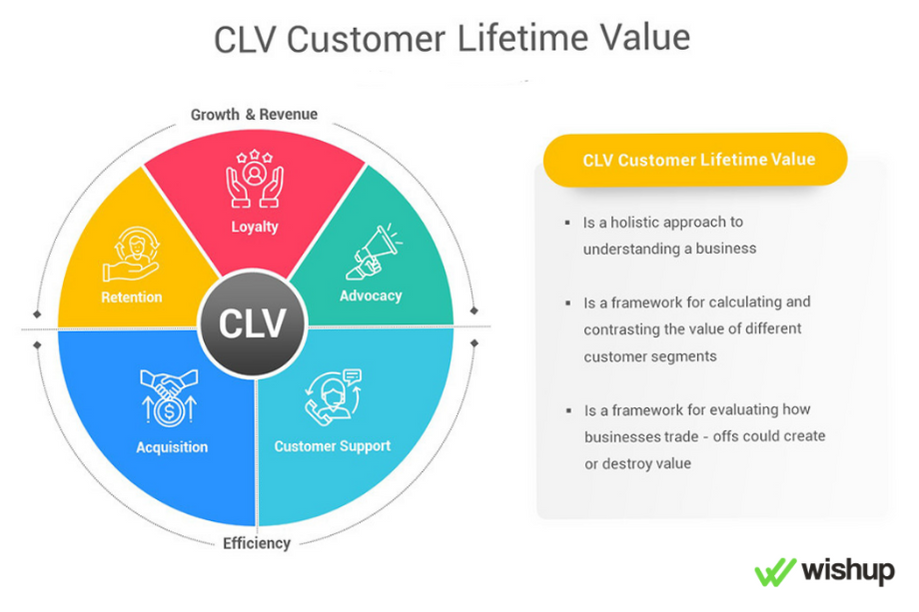

Customer Lifetime Value (CLV) represents the entire financial worth a customer brings to a business throughout their relationship. Unlike evaluating single transactions, CLV considers all potential interactions over the customer’s lifecycle, providing a comprehensive revenue calculation.

Types of Customer Lifetime Value

Historic CLV: Historic Customer Lifetime Value measures the total amount a customer has spent with your business up to the present. For example, if you have purchased a £40 Christmas tree annually from the same vendor for the past ten years, your historic CLV is £400. This metric is useful for understanding the contributions of existing customers and identifying ideal customer profiles, but it doesn’t predict future spending.

Predictive CLV: Predictive Customer Lifetime Value uses algorithms to forecast the potential value and duration of future customer relationships. This approach considers factors such as acquisition costs, average purchase frequency, and operational expenses, providing a realistic prediction of customer lifetime value. Though more complex, predictive CLV offers valuable insights into the best times to invest in customer retention.

CLV vs Other Metrics: Customer Lifetime Value differs from other metrics like Net Promoter Score (NPS), which measures customer loyalty, and Customer Satisfaction Score (CSAT), which assesses satisfaction. Unlike these metrics, CLV is directly tied to revenue, providing a tangible measure of a customer’s financial impact on your business.

Source: McKinsey

Why Calculating Customer Lifetime Value is Crucial for Your Subscription Business

Understanding the importance of calculating customer lifetime value (CLV) is paramount for subscription businesses aiming to thrive. Let’s explore the significant benefits of monitoring CLV for your business.

Identifying High-Value Customers: Businesses need to ensure their marketing investments attract the most profitable customers. But what defines a ‘Best Customer’? The answer varies: it could be the most loyal customers, the most profitable ones, or those easiest to attract and retain.

High-value customers, those with a high CLV, embody all these qualities. By calculating and ranking the CLV of each customer, you can identify these high-value customers. The higher the CLV, the more valuable the customer. Thus, measuring CLV helps you strategically develop your product and tailor your marketing and sales activities to maximise the likelihood of acquiring and retaining such high-value customers.

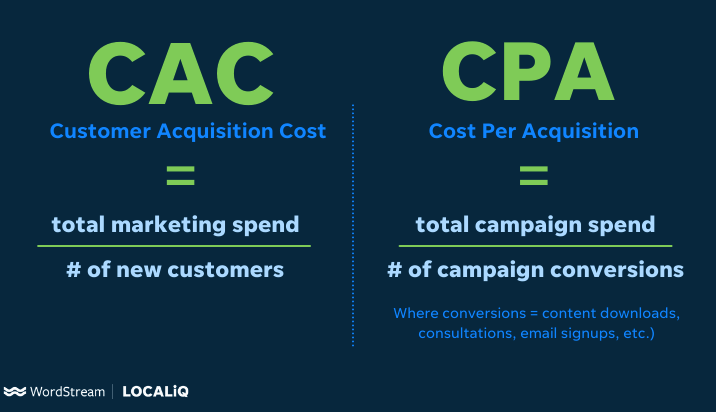

Determining Investment in Customer Acquisition: A significant pitfall for businesses is spending more on acquiring customers than the revenue they generate. This is where understanding the relationship between CLV and Customer Acquisition Cost (CAC) becomes crucial. While CAC tells you how much it costs to acquire a new customer, CLV reveals the worth of that customer to your business.

Balancing these two metrics answers the critical question: “What is the true value of the customer to my business?” Together, CAC and CLV provide a comprehensive Return on Investment (ROI) from an acquired customer, helping to determine whether investment levels are sustainable for long-term business viability and value creation.

What Matters Most?

Focusing on effective segmentation based on predicted customer lifetime value allows organisations to direct their efforts towards high-value segments, ensuring that marketing strategies resonate effectively. Clients often discover that investing in brand loyalty initiatives fosters emotional connections, which typically results in longer-lasting relationships. Furthermore, leveraging predictive analytics often reveals critical insights into purchasing behaviours, helping businesses anticipate customer needs and enhance retention.Get In Touch

What are practical ways to improve Customer Lifetime Value?

Enhance the Onboarding Process

Improving the onboarding process is vital across various industries, as it significantly impacts customer adoption and satisfaction. To optimise this process, focus on making it as straightforward and efficient as possible. This can be achieved by:

- Simplifying steps with walkthrough guides and interactive how-to videos.

- Providing wrapped tutorials and other content that assist customers in achieving their goals.

Customise the onboarding sequence to align with the buyer persona, ensuring you communicate the value of your offering from the outset. Regularly test different onboarding approaches and monitor customer health scores based on their behaviours to refine your strategy.

Provide Value-Packed Content That Keeps Customers Engaged

Email marketing remains one of the most effective methods for customer retention. However, many businesses fall into the trap of running automated drip campaigns without providing tangible value. To maximise engagement and retention, your emails should emphasise the value of your product or service. For instance:

- If you offer accountancy services, send a weekly or monthly email detailing the money saved for clients that month.

- If you provide help desk software, inform clients monthly about the number of support tickets successfully resolved.

- If you sell environmentally friendly products, update customers on the reduction of carbon dioxide emissions compared to competing products.

Offer Live Chat Support

Real-time interaction is crucial, with approximately 80% of business buyers preferring immediate responses. Live chat support on your website or app can meet this need effectively. Statistics reveal that 79% of customers favour live chat for its promptness, and website visitors using live chat are 4.5 times more likely to convert. Implementing live chat can significantly enhance customer satisfaction and conversion rates.

Foster Referrals Through Mutual Rewards

Encourage your existing customers to refer new clients by offering unique rewards such as special discounts or exclusive products. This approach creates a ripple effect, expanding your reach and building a loyal community of advocates.

Harness Personalised Marketing with Precision

Generic marketing is no longer effective. Leverage deep customer insights to create targeted and personalised campaigns that deliver value directly to the customer. This approach transforms marketing from a broad broadcast to a tailored conversation with each individual.

Develop Content That Resonates

Engaging content is not merely about delivering information; it’s about sharing knowledge in an interactive and visually appealing manner. This fosters trust and keeps customers engaged longer. Your content should be designed to resonate deeply with your audience, providing them with valuable insights and encouraging ongoing interaction.

Utilise Data Collection Effectively

One of the most powerful aspects of a loyalty programme is the data it generates. Leveraging this data to its fullest potential allows you to:

- Gain a deeper understanding of your customers, enabling individual tracking and identification.

- Identify effective ways to segment your customer base.

- Target individuals within these segments more precisely.

Effective data utilisation fuels personalisation, driving better customer insights and more tailored marketing strategies. The best loyalty strategies use initial market research to identify and target key segments, then continuously apply and refine this data to enhance the customer value proposition.

Our Tactical Recommendations

In our experience, establishing structured feedback loops enables companies to swiftly adapt to customer needs, leading to increased loyalty. We frequently find that personalised onboarding processes create a strong first impression, laying the groundwork for long-term engagement. Additionally, developing content marketing strategies that educate and nurture customers consistently proves to be a powerful method for maintaining high levels of engagement over time.Get In Touch

What common challenges should I be aware of when calculating Customer Lifetime Value?

Digital Touchpoints

A poor digital strategy is cited by nearly a quarter (23 per cent) of respondents as a barrier to improving customer lifetime value. Moreover, only 15 per cent of respondents strongly agree that they comprehend the key digital touchpoints. As more consumers engage with brands through digital media, understanding how, when, and where consumers are buying, researching, and becoming advocates of a brand becomes crucial for enhancing customer lifetime value.

Working in Silos

Over a third of agency and company respondents highlight that siloed organisations lead to a lack of coherent marketing approaches. The challenge lies in fostering interdepartmental communication to ensure a seamless customer journey, whether the interaction occurs through a call centre or via social media. Almost a third (32 per cent) of respondents believe that a single customer view is the most effective tool for enhancing customer lifetime value.

The Pitfalls of Overestimating Customer Lifespan

Overestimating how long customers will remain engaged with your business can lead to inflated lifetime value projections and subsequent financial challenges. While it’s good to be optimistic, unrealistic forecasts can result in unsustainable marketing expenses. Misjudging the long term value of customers can exhaust resources before achieving the desired return on investment (ROI).

To accurately estimate customer lifespan, it is crucial to perform detailed data analysis, examining purchase history, buying frequency, and retention rates. Complementing this with manual methods such as phone interviews, one-on-one discussions, and customer surveys can provide valuable qualitative data, thereby refining the accuracy of your lifespan estimations.

Comprehensive Calculation of Customer Acquisition Costs

Relying solely on direct costs to calculate Customer Acquisition Cost (CAC) can jeopardise your business’s financial stability. Overlooking hidden expenses such as insurance, maintenance, and operational costs is comparable to buying a luxury car without accounting for its upkeep. For a precise LTV

ratio, consider the following crucial aspects:

- Factor in All Expenses: Include every cost associated with acquiring a customer, covering sales, marketing, commissions, bonuses, and overheads.

- Correct Numerator Usage: In the LTV

equation, ensure the numerator accurately reflects the total expenses incurred in customer acquisition. Ignoring these costs can significantly distort the ratio. - Exclude Non-Paying Customers: When calculating CAC, exclude non-paying customers from the acquisition count to avoid skewed calculations and fluctuating LTV ratios.

By encompassing all relevant expenses and focusing on precise data, you can obtain a realistic LTV ratio, facilitating informed decisions to enhance profitability.