Are you struggling to keep your customers loyal amidst fierce competition? Finding the right pricing strategy can be a game-changer, but it’s often easier said than done.

Imagine a scenario where your pricing not only attracts new customers but also keeps them coming back. In this guide, we’re delving into proven pricing retention strategies that have helped leading companies reduce churn and boost customer loyalty. You’ll discover the tactics that can transform your pricing model into a powerful retention tool—without sacrificing profitability.

- Strategic Pricing: Implement value-based and loyalty-based pricing models to enhance customer retention and foster long-term relationships.

- Overcome Challenges: Address the common challenges in pricing retention by balancing value perception with cost structure to maintain profitability.

- Actionable Adjustments: Regularly analyse and refine your pricing strategies using customer feedback and behaviour insights to improve retention rates.

- B2B SaaS Focus: Leverage tiered pricing strategies specifically tailored for B2B SaaS companies to maintain a competitive edge and reduce churn.

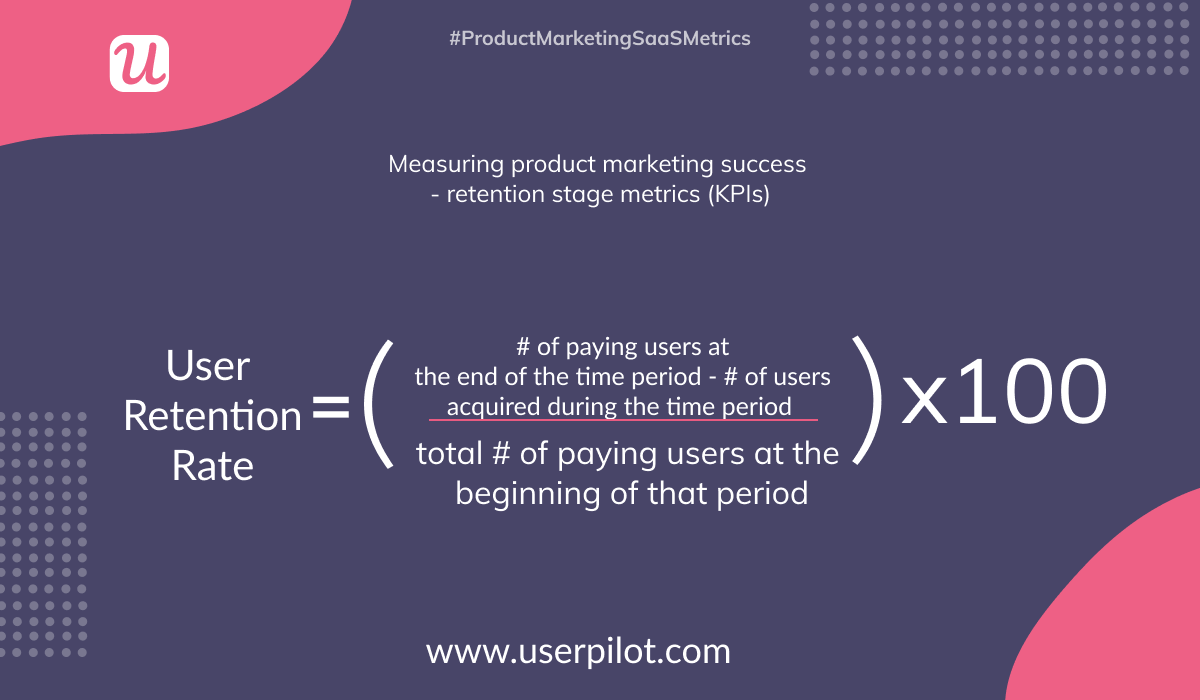

- Measure Success: Track key metrics such as customer lifetime value and retention rates to gauge the effectiveness of your pricing strategies.

What are the key benefits of a competitive pricing strategy for B2B companies?

Crafting a Powerful Retention Pricing Strategy

Implementing a well-thought-out pricing strategy is essential for business success, as it has a direct impact on profitability, competitiveness, and customer retention. For B2B companies, a sound pricing strategy can enhance revenue, expand market share, and differentiate the business from its rivals. Mastering retention pricing is crucial for B2B companies focused on increasing customer loyalty and revenue.

Higher Sales Volume

One of the most notable advantages of competitive pricing is the potential for higher sales volumes. B2B customers are consistently seeking the best value for their investment. By setting optimal prices that consider competitors’ pricing and customer behaviour towards specific product categories, businesses can achieve and sustain higher sales volumes and, consequently, increased revenue. Among the diverse B2B pricing strategies, competitive pricing stands out for its ability to attract and retain customers. Businesses that utilise competition-based pricing to offer their products incentivise customers to choose them over competitors. This strategy can significantly boost sales volume, leading to higher profits.

Better Positioning Against Competitors

Competition-based pricing also enables B2B businesses to position themselves more favourably against their competitors. When a company offers competitive prices, it showcases confidence in its products and services. Moreover, this pricing strategy establishes the business as a formidable market player, making it more challenging for competitors to gain an edge. By adopting this approach, B2B companies can secure a competitive advantage, paving the way for long-term success. Customer loyalty tactics, such as offering competitive pricing, are essential for retaining high-value B2B clients.

Increased Market Share

Utilising competitive pricing allows B2B businesses to expand their market share. With a compelling value proposition and optimal pricing, companies attract new B2B customers who are likely to maintain the partnership over time. This gradual acquisition of new customers, who previously engaged with competitors, contributes to an increased market share. Consequently, this can lead to higher profits and further solidify the business’s competitive advantage, ensuring long-term success. Implementing robust pricing retention strategies ensures that businesses not only attract new customers but also retain existing ones.

What Matters Most?

From our experience, pricing retention strategies often succeed when they align closely with the evolving value perception of the customer. Clients typically discover that pricing should not only reflect usage but should be tied to the tangible success customers derive from the product. Another critical factor is creating a pricing structure that is both adaptable and transparent, which reduces friction during renewals and makes it easier to communicate pricing changes. Lastly, long-term contracts help stabilise retention, but only if they are aligned with customers’ business growth and tied to ongoing value delivery.Get In Touch

How can diverse pricing strategies enhance customer retention?

Competitive Pricing

Competitive pricing, also known as competitor-based or competition-based pricing, involves setting prices based on the benchmarks established by rival firms. This approach does not factor in the actual cost of the product or market demand. Instead, businesses position their prices just below, equal to, or slightly above those of their competitors. This method is particularly effective in highly saturated markets where a business can offer unique differentiators, such as superior customer service, an outstanding loyalty programme, or a generous return policy.

Cost-Plus Pricing

Cost-plus pricing, often employed by retailers and companies selling physical goods, involves adding a predetermined percentage to the cost of production. Also referred to as mark-up pricing, this technique calculates the total cost, including fixed and variable expenses, and then adds a mark-up to ensure profit. Although straightforward, this method doesn’t always align with market dynamics or customer perceptions, potentially affecting the effectiveness of retention pricing strategies.

Dynamic Pricing

Dynamic pricing, also known as time-based, demand, or surge pricing, is a flexible strategy where prices fluctuate based on customer preferences and market conditions. Utilised by industries such as utilities, travel, and hospitality, sophisticated algorithms adjust prices in real-time, considering factors like demand and competitor pricing. This approach allows businesses to maximise revenue during peak times while appealing to price-sensitive customers during off-peak periods. This strategy can be crucial for effective pricing retention.

Freemium Pricing

Freemium pricing, commonly used by Software as a Service (SaaS) and technology companies, merges “free” and “premium” offerings. Typically, a business provides a basic version of their product or service at no cost, hoping that users will eventually upgrade to a paid version for additional features. This strategy is particularly effective in b2b SaaS customer retention strategies, as it allows users to experience the value of the product before committing to a purchase.

Source: Forrester

Flat Rate or Fixed Pricing Model

The flat rate or fixed pricing model offers products at a consistent price, making it ideal for subscription services where users interact with the brand in similar ways. This model is particularly effective for subscription box businesses or services offering unlimited access for a set monthly fee. Some brands also innovate with sequential subscriptions, where customers pay a one-time fee for a product requiring regular replacements.

Tiered Pricing

Tiered pricing structures different levels (basic, standard, premium) that customers can choose from based on their needs and budget. Popular among SaaS companies with varying feature sets, this model caters to diverse customer requirements and is an integral part of b2b pricing strategies.

Pay-As-You-Go Model

The pay-as-you-go model, also known as usage-based pricing, charges customers based on their use of products or services over time. This flexible approach is commonly used by direct-to-consumer (DTC) brands, allowing subscribers to select and pay for products they use, enhancing customer satisfaction and retention.

Time and Loyalty-Based Pricing

Time and loyalty-based pricing involves offering discounts that vary based on the duration of a customer’s commitment or the length of a contract. For example, while a single issue of Private Eye magazine costs £2.94 at newsagents, an annual direct debit subscription is priced at £30 (including delivery), compared to £34.00 for an annual credit card subscription. The lower direct debit rate incentivises long-term commitment, with the added benefit of free Christmas cards.

These pricing models go beyond simple discounts, providing incentives for prolonged usage of existing services or for adding new services to an account. The more a customer utilises the services, the greater their benefits, making this strategy a key component of effective customer loyalty tactics.

Frequent flyer programmes also use similar systems. Time and loyalty-based pricing works well for contracts between businesses and customers, where the relationship’s duration can be measured and appropriate discounts applied. This strategy is essential for retention pricing, fostering enduring customer relationships.

Multi-Product Pricing

Multi-product pricing connects the discounted sale of a primary product to a long-term agreement where customers purchase related products or services exclusively from your business. For instance, selling a copier at a discount in exchange for a commitment to buy toner cartridges, paper, and services exclusively from you. This strategy not only provides a steady income stream to balance the discounted product but also serves as an effective deterrent against lower-priced competition due to the long-term customer commitment.

In some scenarios, the primary product may even be sold at a loss to attract customers. This approach can significantly boost customer loyalty and commitment, although it requires additional measures to sustain retention after the agreement ends.

Another variation is product bundling, which combines several products and services typically sold separately into a single package offered at a substantial discount compared to the total price of the individual items. This method enhances pricing retention by delivering greater value to customers, encouraging them to purchase bundled products and services, and increasing overall satisfaction and loyalty.

Source: Act-On

What steps should I follow to create a strong retention pricing strategy?

Before a business can set prices for its offerings, it must conduct thorough due diligence to ensure that the price is appropriate for both its customers and its bottom line. The following six steps outline the retention pricing process, providing a foundation for effective b2b SaaS customer retention strategies and b2b pricing strategies.

Know Your Business

In the first step of the pricing process, the business delves deeply to determine its needs and constraints. It’s crucial to identify the point at which a price is too low, causing the business to lose money on each transaction. This involves understanding the business’s fixed and variable costs and determining how much needs to be sold to break even at different price points. Additionally, it is essential to assess the maximum production capacity before substantial investment is required to increase sales. This foundational analysis is critical for developing effective pricing retention strategies.

Assess the Target Market’s Demands

Once the business has a clear understanding of its own needs, it’s time to gather comprehensive information about its current and potential customers. This includes understanding what customers think about the business’s product or service, the problems it solves for them, and how many non-customers share the same problem. Evaluating how eager or hesitant the target customers are to find a better solution or try something new is also crucial. Knowing what is most important to them and where price falls on their priority list helps in tailoring customer loyalty tactics. Additionally, understanding the size of the total market and factors that could influence its growth or shrinkage is vital.

Evaluate Competitor Pricing

The next step is to evaluate competitors and other next-best alternatives. For instance, a startup ride-sharing service should not only analyse Uber and Lyft’s pricing but also review taxi, bus, and car rental prices. Underpricing a close competitor can be a significant advantage, potentially doubling sales and more than compensating for any margin cuts. Conversely, pricing slightly higher than the competition could signal superior product quality. This step is a key element in developing robust b2b pricing strategies that ensure competitive positioning.

Choose a Pricing Objective

Before establishing a pricing strategy, the business must be clear about what the strategy needs to accomplish and ensure alignment among all teams. Is the objective to maximise profits, increase market share, build the brand, or simply navigate through challenging times? The objective will ultimately drive the strategy, providing a clear direction for implementing effective pricing retention tactics.

Select a Pricing Strategy

Choosing a pricing strategy, or a mix of strategies, is the next step. The goal is to ensure that the chosen strategy is appropriate for the product, well-received by customers, executable by staff, and capable of driving progress towards the main pricing objective. This step integrates various retention pricing strategies to create a cohesive approach.

Determine Your Prices

With the strategy in hand, the next step is to set prices. The information gathered about the business informs realistic prices and sales forecasts. Customer information ensures the prices will be attractive to them, while competitive information positions prices appropriately in the market. Pricing decisions are the culmination of a long process of research and analysis, but it is important to remember that this process is somewhat forgiving. If the business misses the right price by a small margin, adjustments can usually be made promptly. The best companies incorporate new information quickly, continuously refining their pricing strategies to optimise performance.

Our Tactical Recommendations

In our work, clients often discover that proactively testing price elasticity is essential to managing retention effectively—small price increases can lead to unexpected churn if not tested in controlled environments. Another key tactic is to incentivise annual contracts by offering price stability, which minimises churn risk, especially for sensitive customer segments. Lastly, we typically see the value in introducing clear, structured price adjustments that are communicated well in advance. This approach reduces backlash and keeps customers engaged, ensuring that price changes feel justified and transparent.Get In Touch

How do I avoid common pitfalls in retention pricing?

Not Spending Enough Time on Your Pricing

In examining the pricing strategies of SaaS companies with annual revenues between $5 million and $100 million, we discovered that the average executive spends a mere 11.5 hours throughout their business’s lifetime defining, testing, and adjusting their pricing. This lack of attention can be detrimental to effective retention pricing.

How can you avoid this mistake?

- Create a Pricing Committee: This committee should include employees from Marketing, Sales, Product, and Management, along with a main decision-maker (e.g., the CEO). The committee’s role is to review and adjust pricing strategies regularly.

- Regular Reviews: Every six months, assess your current pricing, compare it with competitors, and gather customer feedback. This review process ensures that your pricing remains competitive and aligned with market expectations.

- Conduct Customer Research: Use surveys and feedback forms to understand what your customers are willing to pay for different features. This insight can reveal the true value of your product and inform pricing adjustments.

Not Localising Your Pricing

Trust is a significant driver behind purchases. If customers don’t trust your copywriting, payment processor, or website design, they won’t proceed with a purchase. Similarly, if your pricing isn’t in a familiar currency, it can deter potential buyers.

How to start localising your pricing:

- Identify User Locations: Use tools like Google Analytics to determine where most of your potential users are located. Ensure that the majority of visitors see prices in their local currency, unless your product is unavailable in their region.

- Localise Other Aspects of Your Site: Beyond pricing, localise content to the local language and use relevant images. This builds trust and makes your site more appealing to international users.

Not Continually Optimising

Even if your current pricing is well-researched and customer-approved, the biggest mistake is to set it and forget it. Pricing should be an ongoing process of refinement and optimisation to ensure long-term success in retention pricing.

Key steps for continuous optimisation:

- Monitor Demand: Keep track of new subscriptions, customer inquiries about specific features, and shifts in competitor behaviour. These indicators can suggest changes in perceived value and willingness to pay.

- Update Your Pricing Page: Regularly revise how you present pricing to customers. Highlight new features, experiment with creative plan names, and update the design to keep it fresh and appealing. This continuous optimisation ensures that your pricing strategies remain effective and relevant.